How Mathematics Obscures Conceptual Errors

|

|

It is not because he is a leader of industry that a man is a capitalist; on the contrary, he is a leader of industry because he is a capitalist. The leadership of industry is an attribute of capital, just as in feudal times the functions of general and judge were attributes of landed property. (Marx 1977, Chap. 13, 450-451).

|

But this is a colossal blunder if it is meant as a description of property rights—as opposed to bargaining power. Of course, “capital” has the bargaining power particularly in the usual description of a “competitive market” where “collusion in constraint of trade” is forbidden on the part of labor-suppliers and labor-demanders. The typical “labor-demander” is a corporation wherein hundreds, thousands, or millions of capital-owners (i.e., the shareholders) are allowed to bargain as one legal party. Then in the “majestic equality” of neoclassical theory, the labor-suppliers (individual workers) and labor-demanders (individual corporations) are alike forbidden to collude together in labor unions or in corporate cartels to gain non-competitive bargaining power.

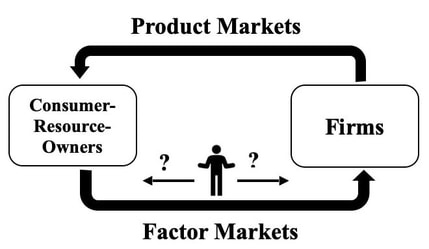

The imagery of neoclassical theory gets worse—even prior to considering the property fallacy of the fundamental myth. The conventional circular flow picture assumes that firmhood is determined prior to market activity. The resource owners are lined up on one side and the “firms” are supposedly lined up on the other side of the input markets. But this is not the case in a free enterprise market economy.

The imagery of neoclassical theory gets worse—even prior to considering the property fallacy of the fundamental myth. The conventional circular flow picture assumes that firmhood is determined prior to market activity. The resource owners are lined up on one side and the “firms” are supposedly lined up on the other side of the input markets. But this is not the case in a free enterprise market economy.

Figure 1: Circular Flow Diagram: Indeterminacy of Who Hires What or Whom

It is not legally predetermined that an input owner is a supplier of inputs rather than a demander of a complementary set of inputs. In particular, it is not legally predetermined that a capital owner (corporate or not) is a labor demander rather than a capital supplier. Prior to the market contracts, corporations are just other input owners. Any resource owner, corporate or otherwise, may aspire to be a “firm” in the technical sense of a going-concern by attempting to purchase the complete set of inputs to a productive opportunity. Prior to market contracts, legal parties are not associated with production sets, so input demand and output supply schedules are not even well-defined.

The fundamental myth implies that the very designation of the system as “capitalism” is a misnomer. This is even recognized by one of the more profound defenders of “the system,” Frank Knight, who also traced the misconception back to Marx.

The fundamental myth implies that the very designation of the system as “capitalism” is a misnomer. This is even recognized by one of the more profound defenders of “the system,” Frank Knight, who also traced the misconception back to Marx.

|

Karl Marx, who in so many respects is more classical than the classicals themselves, had abundant historical justification for calling, i.e., miscalling—the modern economic order “capitalism.” Ricardo and his followers certainly thought of the system as centering around the employment and control of labor by the capitalist. In theory, this is of course diametrically wrong. The entrepreneur employs and directs both labor and capital (the latter including land), and laborer and capitalist play the same passive role, over against the active one of the entrepreneur. It is true that entrepreneurship is not completely separable from the function of the capitalist, but neither is it completely separable from that of labor. The superficial observer is typically confused by the ambiguity of the concept of ownership. The owner of an enterprise may not own any of the property employed in it; and further reflection will show that the same item of property may in different senses be owned entirely, or in widely overlapping degrees, by a considerable number of proprietors. (Knight 1956, p. 68, fn. 40)

|

Because of the precision of the mathematics, the property theoretic error can be pin-pointed in the Arrow-Debreu model. Shareholders do indeed own corporations, but corporations do not own production sets. There is no problem in assuming that the ith consumer owns “a contractual claim to the share aij of the profit of the jth production unit (Arrow and Debreu 1954, p. 270) where “production unit” is a corporation. The problem is in the assumption that for “each production unit j, there is a set Yj of possible production plans” (p. 267) where no other party, aside from the jth corporation, can utilize those production possibilities. In a private enterprise market economy, there is no such property right as the “ownership” of production sets of feasible production vectors.

In the Arrow-Debreu model each consumer-resourceholder is endowed prior to any market exchanges with a certain set of resources and with shares in corporations. But, prior to any market activity, ownership of corporate shares (e.g., the shares in Chrysler Inc.) is only an indirect form of ownership of resources, the corporate resources (e.g., the factory purchased from Bragg Manufacturing Inc. and leased out to Studebaker-Packard Inc.). It is the subsequent contracts in input markets which will determine whether a corporation, like any other resource-owner, successfully exploits a production opportunity by purchasing the requisite complementary inputs and appropriating the produced outputs—or whether those resources are sold or rented to another party.

Production as Arbitrage between Input and Output Markets

We might call the question of “who hires what or whom” the “hiring conflict” since in the context of prices that yielded positive pure profits, it is a game theoretically indeterminate conflict over who will receive those positive profits. Any proposed set of contracts that yielded one party positive profits could be upset by anyone else offering the input suppliers slightly more so that a slightly smaller level of positive profits would remain. This can be modeled by the dollar-division game where a dollar is given to three people and they can divide it in any way so long as a majority agree to the division. But no division can be a solution since any one party can propose another division to benefit that person and one other person.

In the idealized frictionless world of Arrow and Debreu, such a transaction is perfectly possible, and, indeed, production is a form of arbitrage between input markets and output markets (buy low on input markets and sell high on output markets). Since the proposed set of contracts yielding positive profits could be upset by another party willing to accept a slightly lower level of pure profits, there can be no competitive equilibrium with positive pure profits.

Thus, we have reached what, pace Arrow and Debreu, should be an unsurprising result—there can be no competitive equilibrium in the presence of profitable arbitrage possibilities. How do Arrow and Debreu manage to prove otherwise? Simply by not allowing anyone else to demand the other inputs except the corporation that is “identified” with the production set. But as the trivial possibility of hiring out corporate capital assets reveals (e.g., in the Chrysler example), there is no “identification” between corporations and production sets (or production functions). Firmhood is determined within the marketplace by the pattern of who hires what or whom, and is not determined by the given initial distribution of corporate ownership. The basic property theoretic modeling error in the AD model is the assumption that corporations “own” production sets.

This result restores the symmetry between the different returns to scale. There can be no competitive equilibrium with increasing returns to scale because no one wants to be the firm (due to negative profits), and, symmetrically, there can be no competitive equilibrium with decreasing returns to scale because everyone wants to be the firm (due to positive profits). As Lionel McKenzie has consistently and correctly argued from the beginning and reiterated in his Presidential Address to the Econometric Society, there can only be a competitive equilibrium under constant returns to scale (where profits are zero and firmhood is indeterminate) (McKenzie 1981).

Mistaking Transaction Cost Barriers as “Ownership of the Firm”

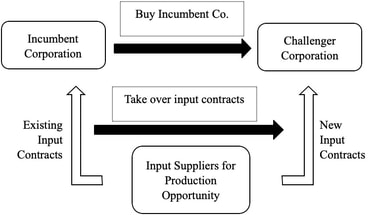

The phrase “ownership of a firm” is a very slippery expression. Its meaning can slide around in the middle of an argument to suit the ends at hand. It usually means ownership of a corporation that is currently engaged in a production process. We have already shown that it is the pattern of the input contracts that makes the corporation the owner of the outputs of the production process. A rearrangement of the input contracts would switch firmhood or residual claimancy to another party and reduce the corporation to an input supplier role—all without changing the ownership of the corporation. But in realistic markets (unlike the AD model), there are huge transaction costs to rearranging the input contracts. The incumbent corporate residual claimant has sizable first-mover advantages so that any challenging party would have to incur such high transaction costs to redirect the input contracts that it might be just as cheap or cheaper to simply buy the corporation and thereby take over the residual claimant's position in the existing pattern of input contracts. It is these transaction cost barriers which create the image that the existing corporate residual claimant “owns” the production opportunity.

Figure 2: Two Ways to Take Over a Production Opportunity

One of the advantages of idealized frictionless models in economics, as in physics, is that they show the basic logic of the system without irrelevant distractions. We saw in the transactions-cost-free world of the Arrow-Debreu model that input contracts could be costlessly rearranged to switch residual claimancy from one party to another without changing the ownership of a corporation from one party to another. That is part of the basic logic of a private property market economy, and it precisely this logic that Arrow and Debreu fail to model correctly. That is how they get the basic logic of a private property market economy wrong.

The transaction cost barriers to rearranging contracts in realistic markets create the illusion of a property right such as Arrow and Debreu's “ownership of a production set” or the everyday notion of “ownership of the firm.” Transaction cost barriers are only that; they are not property rights. For instance, as transaction costs change it might become more feasible to acquire residual claimancy by rearranging input contracts rather than by purchasing the corporation. This would not violate the corporation's “ownership of the production set” since it had no such property right in the first place.

Economists ordinarily take great pride in using their abstract models to reveal fallacies in everyday lay economic reasoning (e.g., about supply and demand). The lay notion of “ownership of the firm” is so basic and widespread that we have called it the “fundamental myth” of capital-ist ideology (Ellerman 1992). The idealized frictionless model can be similarly used to expose the transactions-cost-based illusion in this lay notion of “ownership of the firm” and to demonstrate the contractual nature of firmhood or residual claimancy. Yet Arrow and Debreu directly import the lay notion into their frictionless world where the fallacy is obvious to all who are willing to see it. In spite of the voluminous literature about transactions costs and property rights, there seems to be a studied incapacity to derive this result about the “fundamental myth” of the property system. Indeed, the importance of the arguments outlined above lies not in what they show about that creature of academic economics called the “Arrow-Debreu model” but in what they show about the basic logic of a market economy (transactions costs or not) where all factors are rentable.

Endgames to Defend the Fundamental Myth

Defining Away the Problem with Owner-Specified Outputs

There are a number of “endgames” that are used to try to defend the fundamental myth that corporations “own” production opportunities (rather than just owning some of the inputs to the opportunities). One strategy is simply to define the output as being that owned by the corporation, so this blocks some other party from owning that output by simply rearranging the input contracts. In our example, we showed that ABC Corporation owned Q because it owned the used-up inputs, the capital services K and the labor services L, and if any other party by a rearrangement of the input contracts owned K and L then that party would own Q without having to buy ABC Corporation. But a common reply to this argument by lay and professional economists is that the ownership of “ABC's output Q” is part of the ownership of ABC Corporation, so some other party would have to buy ABC to get the ownership of ABC's Q. But this formulation already assumes that Q is defined as “ABC's output” and thus it begs the real questions as to how Q got to be ABC's output as opposed to some other party's output—a question which is answered by looking at which party owned the input services used up in the production of Q, i.e., by considering who rents what or whom in the marketplace. The auto bodies coming off the assembly line in the factory owned by Chrysler were not “Chrysler’s output Q” since the factory was leased to Studebaker-Packard.

One could similarly beg the price-theoretic question of how price is determined by incorporating price in the specification of a commodity. One does need any price theory to determine the price of a “$2 chunk of cheddar cheese.” But one does need some theory of price to determine how this chunk of cheddar cheese (specified otherwise than by price) has a $2 price. In a similar manner, one doesn't need any property theory to determine who owns the “Briggs auto bodies” that roll out one end of a production building owned and operated by Briggs, but one does need to reconsider the owner of the auto bodies (sans Briggs specification) that roll out of the same production building when owned by Chrysler—and leased to and operated by Studebaker-Packard.

Hidden-Factor Ploys

Another common ploy (more favored by academic than lay economists) to salvage “ownership of production functions” is to build some privately-owned factors into the “shape” of the production function or set. Since these factors are not shown in the notation of the production function or set, one cannot represent in such a model the possibility of some other party renting that factor. Hence one can supposedly say the owner of the hidden factor “owns” the production function. This seems to introduce the methodological innovation of “proof by bad notation.” But this is not a joke. It was the ploy used by Arrow and Hahn in their treatment of the AD model.

McKenzie (1981, 2002), Koopmans (1957, p. 65), and others have interpreted the Arrow-Debreu model as assigning production sets to specific parties by postulating “hidden factors” owned by the parties. But this compromises the model in a number of ways (see Ellerman 1982, Chapter 13; or McKenzie 1981). Firstly, there are no non-market-able privately owned input services, and Arrow and Debreu have identified none. Some hidden factors which might be used to supposedly justify decreasing returns are not privately owned, e.g., publicly-owned (congested public roads) or unowned natural factors. The existence of unowned or publicly-owned factors does not account for the assignment of production sets to specific parties. Arbitragers also have access to those factors so they could defeat any proposed equilibrium with positive pure profits.

Arrow and Hahn try to replace “not market-able” with “not market-ed.” But it is incoherent to simply assume that “not all inputs are, in fact, marketed” (Arrow and Hahn 1971, p. 61) when the production sets are first being specified.

The transaction cost barriers to rearranging contracts in realistic markets create the illusion of a property right such as Arrow and Debreu's “ownership of a production set” or the everyday notion of “ownership of the firm.” Transaction cost barriers are only that; they are not property rights. For instance, as transaction costs change it might become more feasible to acquire residual claimancy by rearranging input contracts rather than by purchasing the corporation. This would not violate the corporation's “ownership of the production set” since it had no such property right in the first place.

Economists ordinarily take great pride in using their abstract models to reveal fallacies in everyday lay economic reasoning (e.g., about supply and demand). The lay notion of “ownership of the firm” is so basic and widespread that we have called it the “fundamental myth” of capital-ist ideology (Ellerman 1992). The idealized frictionless model can be similarly used to expose the transactions-cost-based illusion in this lay notion of “ownership of the firm” and to demonstrate the contractual nature of firmhood or residual claimancy. Yet Arrow and Debreu directly import the lay notion into their frictionless world where the fallacy is obvious to all who are willing to see it. In spite of the voluminous literature about transactions costs and property rights, there seems to be a studied incapacity to derive this result about the “fundamental myth” of the property system. Indeed, the importance of the arguments outlined above lies not in what they show about that creature of academic economics called the “Arrow-Debreu model” but in what they show about the basic logic of a market economy (transactions costs or not) where all factors are rentable.

Endgames to Defend the Fundamental Myth

Defining Away the Problem with Owner-Specified Outputs

There are a number of “endgames” that are used to try to defend the fundamental myth that corporations “own” production opportunities (rather than just owning some of the inputs to the opportunities). One strategy is simply to define the output as being that owned by the corporation, so this blocks some other party from owning that output by simply rearranging the input contracts. In our example, we showed that ABC Corporation owned Q because it owned the used-up inputs, the capital services K and the labor services L, and if any other party by a rearrangement of the input contracts owned K and L then that party would own Q without having to buy ABC Corporation. But a common reply to this argument by lay and professional economists is that the ownership of “ABC's output Q” is part of the ownership of ABC Corporation, so some other party would have to buy ABC to get the ownership of ABC's Q. But this formulation already assumes that Q is defined as “ABC's output” and thus it begs the real questions as to how Q got to be ABC's output as opposed to some other party's output—a question which is answered by looking at which party owned the input services used up in the production of Q, i.e., by considering who rents what or whom in the marketplace. The auto bodies coming off the assembly line in the factory owned by Chrysler were not “Chrysler’s output Q” since the factory was leased to Studebaker-Packard.

One could similarly beg the price-theoretic question of how price is determined by incorporating price in the specification of a commodity. One does need any price theory to determine the price of a “$2 chunk of cheddar cheese.” But one does need some theory of price to determine how this chunk of cheddar cheese (specified otherwise than by price) has a $2 price. In a similar manner, one doesn't need any property theory to determine who owns the “Briggs auto bodies” that roll out one end of a production building owned and operated by Briggs, but one does need to reconsider the owner of the auto bodies (sans Briggs specification) that roll out of the same production building when owned by Chrysler—and leased to and operated by Studebaker-Packard.

Hidden-Factor Ploys

Another common ploy (more favored by academic than lay economists) to salvage “ownership of production functions” is to build some privately-owned factors into the “shape” of the production function or set. Since these factors are not shown in the notation of the production function or set, one cannot represent in such a model the possibility of some other party renting that factor. Hence one can supposedly say the owner of the hidden factor “owns” the production function. This seems to introduce the methodological innovation of “proof by bad notation.” But this is not a joke. It was the ploy used by Arrow and Hahn in their treatment of the AD model.

McKenzie (1981, 2002), Koopmans (1957, p. 65), and others have interpreted the Arrow-Debreu model as assigning production sets to specific parties by postulating “hidden factors” owned by the parties. But this compromises the model in a number of ways (see Ellerman 1982, Chapter 13; or McKenzie 1981). Firstly, there are no non-market-able privately owned input services, and Arrow and Debreu have identified none. Some hidden factors which might be used to supposedly justify decreasing returns are not privately owned, e.g., publicly-owned (congested public roads) or unowned natural factors. The existence of unowned or publicly-owned factors does not account for the assignment of production sets to specific parties. Arbitragers also have access to those factors so they could defeat any proposed equilibrium with positive pure profits.

Arrow and Hahn try to replace “not market-able” with “not market-ed.” But it is incoherent to simply assume that “not all inputs are, in fact, marketed” (Arrow and Hahn 1971, p. 61) when the production sets are first being specified.

|

For any vector y, let yM and yP be the vectors formed by considering only the marketed and private components, respectively. For the firm, assume that the private components are given:... From the viewpoint of the study of markets, only the vector yM is relevant. (Arrow and Hahn 1971, p. 61)

|

Arrow and Hahn then restrict the production vectors to their “marketed” components and leave the “private” components implicit in the shape of the production sets (all prior to the determination of any equilibrium prices). But whether an input is marketed or held for private uses will depend on the equilibrium configuration of prices (which are hardly known or assumed when production sets are first being specified).

The Arrow-Hahn tactic is not only methodologically incoherent; it could be inconsistent with the other assumptions. As Edwin Burmeister has pointed out:

|

(A) formulation which assumes that certain markets do not exist is incomplete and, more importantly, it may be inconsistent with profit maximization. (Burmeister 1974, pp. 414-415)

|

Suppose an economic reform was in the past instituted in communist Russia where some inputs were traded on free markets with factory managers instructed to maximize profits, but certain other inputs were designated as “not marketed” and were not exposed to market forces (see previous Arrow and Hahn quote). Neoclassical economists would be very quick to point out that if some factors were hidden from exposure to scarcity-reflecting market prices, then there could no assurance that the factors would be efficiently allocated. Any “efficiency theorem” the Russians might derive would be bogus due to the existence of the non-marketed hidden factors that are not exposed to market signals. Unfortunately, neoclassical economists display a learned ignorance of this critical but rather elementary insight when Arrow and Hahn use the same tactic (p. 61) and then claim to prove the equally bogus “efficiency theorem” for their model (p. 110).

In reviewing a book about Nicholas Kaldor, Frank Hahn (of Arrow and Hahn 1971) seems to have had second thoughts.

In reviewing a book about Nicholas Kaldor, Frank Hahn (of Arrow and Hahn 1971) seems to have had second thoughts.

|

(Kaldor insisted) that perfectly competitive general equilibrium only made sense under constant returns. To economists brought up on Arrow-Debreu this seems plainly wrong. Constant returns are not assumed. (Hahn 1988, p. 1746)

|

Citing modern work by McKenzie and others that does not assume the identity of firms to be given prior to market activity, Hahn concludes that Kaldor was “substantially right” (p. 1746). So, McKenzie was also right all along that when all factors are exposed to market forces and are rentable or publicly available, then there can be no equilibrium except under constant returns to scale and zero profits.

In McKenzie’s book on general equilibrium theory (2002), he presents both his model and the Arrow-Debreu model. For his model, he presents production possibilities as convex cones of activities (i.e., constant return to scale) where “In the economy of activities the individual firms are suppressed.” (McKenzie 2002, p. 197). When presenting the AD model, McKenzie interprets it as using the hidden non-marketed factor ploy that was quite explicit in the Arrow-Hahn book (1971).

In McKenzie’s book on general equilibrium theory (2002), he presents both his model and the Arrow-Debreu model. For his model, he presents production possibilities as convex cones of activities (i.e., constant return to scale) where “In the economy of activities the individual firms are suppressed.” (McKenzie 2002, p. 197). When presenting the AD model, McKenzie interprets it as using the hidden non-marketed factor ploy that was quite explicit in the Arrow-Hahn book (1971).

|

In the present discussion we will take the diametrically opposed view that the firms are fundamental to production and each firm owns a technology or a possible production set Yf that is given. The firm trades in the goods that are used in production or that issue from production but not in the things that determine the possible production set which it owns. The set of firms, f = 1,..., F, is also given. This approach to the competitive economy was taken by Arrow and Debreu in their classic article (1954). (McKenzie 2002, p. 197)

|

In spite of McKenzie’s earlier remarks on the AD model (1981) and his private remarks to the author, “Actually I have directly challenged the Arrow-Debreu paradigm in my papers subsequent to the 1954 piece.” (McKenzie 1986), he only focused on the mathematics in his book (2002). He left unmentioned the point that there is no ownership of production sets in a private property market economy where all factors (hidden or not) are marketable or publicly available. For instance, there is no “ownership” of the “production set” that economists might associate with the former-Briggs factory owned by Chrysler and leased to Studebaker-Packard. There is the ownership of the factory, but the exploitation of the production possibilities associated with the factory was determined endogenously in the marketplace.

But since Arrow and Debreu used their jerry-rigged model to supposedly prove the existence of competitive equilibrium in the general case of non-increasing returns to scale and positive pure profits, they were “sainted” with Nobel Prizes in Economics—while McKenzie (who correctly restricted his model to constant returns) was passed over for the Nobel Prize.

Criticisms by Kornai and others of the Arrow-Debreu model

The criticisms given here, like the critics of the hidden non-marketed factor ploy, e.g., McKenzie (1981), Koopmans (1957), or Burmeister (1974), point out conceptual errors and incoherence in the Arrow-Debreu model. However, the ‘standard criticisms’ of the Arrow-Debreu model have focused on the unreality of its assumptions. In addition to the run-of-the-mill criticisms of the idealized consumer-resource owners and firms and in view of the importance of increasing returns in actual economies (Young 1928), Nicholas Kaldor (1972) at least made a more significant but still empirical criticism of the assumption of non-increasing returns.

But, quite aside from Arrow and Debreu, the perfectly competitive model was never intended by serious thinkers (as opposed to writers of popular texts) as a model of an actual private property market economy. As Frank Knight put it:

But since Arrow and Debreu used their jerry-rigged model to supposedly prove the existence of competitive equilibrium in the general case of non-increasing returns to scale and positive pure profits, they were “sainted” with Nobel Prizes in Economics—while McKenzie (who correctly restricted his model to constant returns) was passed over for the Nobel Prize.

Criticisms by Kornai and others of the Arrow-Debreu model

The criticisms given here, like the critics of the hidden non-marketed factor ploy, e.g., McKenzie (1981), Koopmans (1957), or Burmeister (1974), point out conceptual errors and incoherence in the Arrow-Debreu model. However, the ‘standard criticisms’ of the Arrow-Debreu model have focused on the unreality of its assumptions. In addition to the run-of-the-mill criticisms of the idealized consumer-resource owners and firms and in view of the importance of increasing returns in actual economies (Young 1928), Nicholas Kaldor (1972) at least made a more significant but still empirical criticism of the assumption of non-increasing returns.

But, quite aside from Arrow and Debreu, the perfectly competitive model was never intended by serious thinkers (as opposed to writers of popular texts) as a model of an actual private property market economy. As Frank Knight put it:

|

Economic theory is not a descriptive, or an explanatory, science of reality. Within wide limits, it can be said that historical changes do not affect economic theory at all. It deals with ideal concepts which are probably as universal for rational thought as those of ordinary geometry. […] The fact that description of ideal behaviour in part explains actual behaviour operates as a source of confusion; the notion that economics is a science explanatory of actual behaviour is the most important single confusion in the methodology of the science. (Knight 1969, pp. 277-79)

|

The competitive model is seen as an abstract idealized model like a frictionless model in physics. Neoclassical economics also interprets the model as a normative “regulative ideal” (in Kant’s phrase); the normative measure to apply to actual economies is how they approximate the competitive ideal and how any such divergence can be reduced.

In addition to Kaldor (1972), Janos Kornai made a broad empirical critique of the AD model in his book Anti-Equilibrium (1971) as an “intellectual experiment” (Ibid., p. 11). But Kornai slowly evolved away from empirical criticism to see the virtues in abstract models.

In addition to Kaldor (1972), Janos Kornai made a broad empirical critique of the AD model in his book Anti-Equilibrium (1971) as an “intellectual experiment” (Ibid., p. 11). But Kornai slowly evolved away from empirical criticism to see the virtues in abstract models.

|

Reality is never so “perfect”. Yet this pure theoretical structure, owing exactly to its “perfection”, seems to be suitable to serve as an abstract frame of reference. (Kornai 1979, p. 196)

|

In Kornai’s more recent intellectual autobiography (2006), he pronounced the “experiment” a failure (Ibid., p. 194; see also Khosravi 2018) as he agreed that the abstract modeler is not attempting a realistic theory.

|

Modelers can be accused of many mistakes, but not of abstracting from reality. That is the essence of building models. The easy way to criticize is to say, look, the model assumes this thing, but in reality everyone sees something else instead. (Kornai 2006, p. 183)

|

Hence in his mature reflections, Kornai concluded that the fault lay not in the academic stars such as Arrow and Debreu, but in the popularizers and textbook writers.

|

I began the section by pointing to an essential mistake in the domain of the philosophy of science in Anti-Equilibrium. I should have attacked not the purity of the theory (the abstract, unreal nature of its assumptions), but the wrong use of it in mainstream economics. The real addressee of the critique should have been mainstream teaching practices and research programs. The creator of a pure theory cannot be obliged to include such a warning in his or her work. (Ibid., pp. 184-5, his italics)

|

In Kornai’s institutional writings, he understood—but did not elaborate on—the fallacy behind the fundamental myth that the net income and management rights in a production opportunity are supposedly attached to the ownership of the underlying capital assets. At first, he seems to attach the net income rights (which he called “type a” property rights) to the capital asset

|

a. Rights to residual income. The owner has the right to dispose of the income generated by the property. One generally arrives at a more accurate description by defining this right as one to the residual part of the income, meaning that having deducted all the costs associated with utilization of the property from the income obtained with the help of it, the remaining income belongs to the owner. (Kornai 1992, p. 64)

|

But then Kornai’s footnote 5 tells the different story that the residual income rights are determined by the pattern of market contracts (by who rents what or whom), not simply by the ownership of capital.

|

To clarify the concept of residual income it is worth considering the position of a tenant farmer who pays a fixed rent to the landowner for the use of the land. In this case the residual income is made up of the income from the produce of the land, less all costs, including the rent. To that extent, it is the tenant who has type a property rights over the produce and not the landowner. (Ibid., fn. 5, p. 64)

|

Now Kornai has in his hands the necessary insight to explain why the “given” ownership of corporations in the idealized Arrow-Debreu model would not rule out the arbitrage that would change “who rents what or whom” in the presence of positive pure profits.

Unfortunately, Kornai does not apply this insight in his analysis of the AD model in his early or later work. In distinguishing the AD model from McKenzie’s model, Arrow focused on the point about decreasing returns and positive profits.

Unfortunately, Kornai does not apply this insight in his analysis of the AD model in his early or later work. In distinguishing the AD model from McKenzie’s model, Arrow focused on the point about decreasing returns and positive profits.

|

The Arrow-Debreu model creates a category of pure profits [while in] the McKenzie model, on the other hand, the firm makes no pure profits (since it operates at constant returns);… . (Arrow 1971, p. 70)

|

Yet, throughout Kornai’s early and late work, he never really focuses on this point, and, in fact, he constantly refers to the “Walras-Arrow-Debreu” general equilibrium theory and thus overlooks the crucial difference in the models since the Walrasian model had constant returns and zero profits.

Concluding Remarks

The Arrow-Debreu model mistakes the whole logic of who is to be the firm in a “free market economy.” The question of who appropriates the results of a production opportunity is not settled by the initial endowment of property rights. It is only settled in the markets for inputs by who hires what or whom. This fact reveals another fundamental flaw in neoclassical economics, this time in capital theory and corporate finance theory. Since a firm does not “own” the future contractual behavior of suppliers and customers, the discounted present value of the future profits (“goodwill”) from some assumed behavior cannot be legitimately added to the value of some present property such as a capital asset or a corporation—as is done in those theories. Hence, an understanding of the property flaw (the non-ownership of production functions or sets) in the AD model opens the way to the conceptual criticism of neoclassical capital theory and corporate finance theory (see Ellerman 1992).

In a private property market economy, it is not “given” that a capital owner (corporate or not) is a labor-demander rather than a capital-suppler, and similarly for a land-owner or labor-owner. In the usual “circular flow diagram” of the textbooks, it is not predetermined if a given resource-owner stays on the seller side of the “factor markets” or moves over the firm side of the market as a buyer of a complementary set of resources to undertake production.

In other words, the determination of who is to be the “firm” is not exogenous to the marketplace; it is a market-endogenous determination. This adds a new degree of freedom (who is to be the firm as a going-concern?) to the model which can only be ignored in the special case of constant returns and zero economic profits when it doesn't matter (at least for price theory) who is the firm. This new degree of freedom eliminates the possibility of a competitive equilibrium with positive economic profits, e.g., with decreasing returns to scale in some production opportunity. Thus the Arrow-Debreu model does not correctly model a perfectly idealized competitive equilibrium in a private property market economy where all factors are rentable or publicly available.

Concluding Remarks

The Arrow-Debreu model mistakes the whole logic of who is to be the firm in a “free market economy.” The question of who appropriates the results of a production opportunity is not settled by the initial endowment of property rights. It is only settled in the markets for inputs by who hires what or whom. This fact reveals another fundamental flaw in neoclassical economics, this time in capital theory and corporate finance theory. Since a firm does not “own” the future contractual behavior of suppliers and customers, the discounted present value of the future profits (“goodwill”) from some assumed behavior cannot be legitimately added to the value of some present property such as a capital asset or a corporation—as is done in those theories. Hence, an understanding of the property flaw (the non-ownership of production functions or sets) in the AD model opens the way to the conceptual criticism of neoclassical capital theory and corporate finance theory (see Ellerman 1992).

In a private property market economy, it is not “given” that a capital owner (corporate or not) is a labor-demander rather than a capital-suppler, and similarly for a land-owner or labor-owner. In the usual “circular flow diagram” of the textbooks, it is not predetermined if a given resource-owner stays on the seller side of the “factor markets” or moves over the firm side of the market as a buyer of a complementary set of resources to undertake production.

In other words, the determination of who is to be the “firm” is not exogenous to the marketplace; it is a market-endogenous determination. This adds a new degree of freedom (who is to be the firm as a going-concern?) to the model which can only be ignored in the special case of constant returns and zero economic profits when it doesn't matter (at least for price theory) who is the firm. This new degree of freedom eliminates the possibility of a competitive equilibrium with positive economic profits, e.g., with decreasing returns to scale in some production opportunity. Thus the Arrow-Debreu model does not correctly model a perfectly idealized competitive equilibrium in a private property market economy where all factors are rentable or publicly available.

References

Arrow, K.J. 1971. “The Firm in General Equilibrium Theory,” in R. Marris and A. Woods (eds.) The Corporate Economy, Cambridge: Harvard University Press.

Arrow, K.J. and Debreu, G. 1954. “Existence of an Equilibrium for a Competitive Economy,” Econometrica. Vol. 22: 265-290.

Arrow, K.J. and Hahn, F.H. 1971. General Competitive Analysis, San Francisco: Holden-Day.

Burmeister, E. 1974. “Neo-Austrian and Alternative Approaches to Capital Theory,” Journal of Economic Literature.Vol. XII: 413-456.

Ellerman, D.P. 1982. Economics, Accounting, and Property Theory, Lexington MA: D.C. Heath.

Ellerman, D.P. 1992. Property & Contract in Economics: The Case for Economic Democracy, Cambridge USA: Blackwell.

Ellerman, D. 2014. “On Property Theory.” Journal of Economic Issues XLVIII (3 Sept.): 601–24. https://doi.org/doi:10.2753/jei0021-3624480301.

von Gierke, O. 1958. Political Theories of the Middle Age. Translated by F. W. Maitland. Boston: Beacon Press.

Hahn, F. 1988. Review of Nicholas Kaldor by Anthony Thirlwall. Journal of Economic Literature. XXVI (Dec. 1988): 1746-1747.

Kaldor, N. 1972. “The Irrelevance of Equilibrim Economics.” Economic Journal 82 (328): 1237–55.

Khosravi, M. 2018. “Janos Kornai and General Equilibrium Theory.” Acta Oeconomica 68 (5): 27–52. https://doi.org/DOI:10.1556/032.2018.68.S.4.

Knight, F. 1956. On the History and Method of Economics. Chicago: Phoenix Books.

Knight, F. 1969. The Ethics of Competition and Other Essays. Freeport NY: Books for Libraries Press.

Arrow, K.J. 1971. “The Firm in General Equilibrium Theory,” in R. Marris and A. Woods (eds.) The Corporate Economy, Cambridge: Harvard University Press.

Arrow, K.J. and Debreu, G. 1954. “Existence of an Equilibrium for a Competitive Economy,” Econometrica. Vol. 22: 265-290.

Arrow, K.J. and Hahn, F.H. 1971. General Competitive Analysis, San Francisco: Holden-Day.

Burmeister, E. 1974. “Neo-Austrian and Alternative Approaches to Capital Theory,” Journal of Economic Literature.Vol. XII: 413-456.

Ellerman, D.P. 1982. Economics, Accounting, and Property Theory, Lexington MA: D.C. Heath.

Ellerman, D.P. 1992. Property & Contract in Economics: The Case for Economic Democracy, Cambridge USA: Blackwell.

Ellerman, D. 2014. “On Property Theory.” Journal of Economic Issues XLVIII (3 Sept.): 601–24. https://doi.org/doi:10.2753/jei0021-3624480301.

von Gierke, O. 1958. Political Theories of the Middle Age. Translated by F. W. Maitland. Boston: Beacon Press.

Hahn, F. 1988. Review of Nicholas Kaldor by Anthony Thirlwall. Journal of Economic Literature. XXVI (Dec. 1988): 1746-1747.

Kaldor, N. 1972. “The Irrelevance of Equilibrim Economics.” Economic Journal 82 (328): 1237–55.

Khosravi, M. 2018. “Janos Kornai and General Equilibrium Theory.” Acta Oeconomica 68 (5): 27–52. https://doi.org/DOI:10.1556/032.2018.68.S.4.

Knight, F. 1956. On the History and Method of Economics. Chicago: Phoenix Books.

Knight, F. 1969. The Ethics of Competition and Other Essays. Freeport NY: Books for Libraries Press.